Before discussing its effect on the cash flow statement, it is crucial to understand the accrual treatment of a sale of a fixed asset. The van’s original cost was $45,000 and its accumulated depreciation was $43,600 as of the date of the sale. Therefore, the van’s book value as of March 31 was $1,400 (cost of $45,000 minus accumulated depreciation of $43,600). Since the $4,000 of cash received by the company was greater than the van’s book value of $1,400, there is a gain on the sale of the van of $2,600 ($4,000 minus $1,400). For Propensity Company, beginning with net income of $4,340, andreflecting adjustments of $9,500, delivers a net cash flow fromoperating activities of $13,840.

( . Adjustments for non-operating gains and losses

The cash impact is the cash proceeds received from the transaction, which is not the same amount as the gain or loss that is reported on the income statement. Gain or loss is computed by subtracting the asset’s net book value from the cash proceeds. Net book value is the asset’s original cost, less any related accumulated depreciation. Propensity Company sold land, which was carried on the balance sheet at a net book value of $10,000, representing the original purchase price of the land, in exchange for a cash payment of $14,800. The data set explained these net book value and cash proceeds facts for Propensity Company. Increases in net cash flow from investing usually arise from thesale of long-term assets.

How to calculate the gain or loss from an asset sale

- For instance, assume that sales are stated at $100,000 on an accrual basis.

- Therefore, always consult with accounting and tax professionals for assistance with your specific circumstances.

- When a company disposes of a fixed asset, it includes two impacts on the cash flow statement.

- This means the book value of the equipment is $1,080 (the original cost of $1,100 less the $20 of accumulated depreciation).

If accounts receivable increased by $5,000, cash collections from customers would be $95,000, calculated as $100,000 – $5,000. The direct method also converts loss on sale of equipment cash flow all remaining items on the income statement to a cash basis. When these transactions occur, companies can record the cash flows in their accounts.

Current Operating Liability Increase

Quick shows the $9,000 inflow from the sale of the equipment on its statement of cash flows as a cash inflow from investing activities. Thus, it has already recognized the total $9,000 effect on cash (including the $2,000 gain) as resulting from an investing activity. Since the $2,000 gain is also included in calculating net income, Quick must deduct the gain in converting net income to cash flows from operating activities to avoid double-counting the gain. When a company disposes of a fixed asset, it includes two impacts on the cash flow statement. As stated above, the first includes withdrawing its accounting treatment.

This helped Dells in the current year but what about next year when they owe $90,000? Gains and Losses are non-cash adjustments because they correspond to long-term Assets purchased in PRIOR periods. Assume you own a specialty bakery that makes gourmet cupcakes.Excerpts from your company’s financial statements are shown. Some required information for the SCF that will be disclosed in the notes includes significant exchanges that did not involve cash, the amount of interest paid, and the amount of income taxes paid.

Financing Activities Leading to an Increase in Cash

Overall, fixed assets are crucial for most companies, specifically capital-intensive ones. Increases in net cash flow from financing usually arise when thecompany issues share of stock, bonds, or notes payable to raisecapital for cash flow. Propensity Company had one example of anincrease in cash flows, from the issuance of common stock.

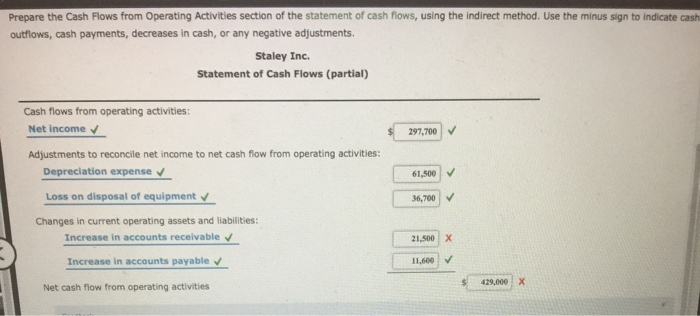

Changes in long-term liabilities and equity forthe period can be identified in the Noncurrent Liabilities sectionand the Stockholders’ Equity section of the company’s ComparativeBalance Sheet, and in the retained earnings statement. When preparing the operating activities section of the statement of cash flows, increases in current assets are deducted from net income; decreases in current assets are added to net income. The real cash flows are those cash receipts that are generated by the disposal of fixed assets or by the sale of the investments themselves. And those cash flows are recorded under the investing activities or financing activities on the cash flow statement. The current asset rule states that increases in current assets are deducted from net income. Thus $60,000 is deducted from net income in the operating activities section of the statement of cash flows.

(Current assets and liabilities are those that are expected to be converted to cash within one year.) Most of a business’ transactions are operating activities. For the financing section, we will use the balance sheet and the statement of retained earnings. On the balance sheet, we are looking at the notes payable – bank from the current liability section and any other long term liabilities. If these balances increased, we can assume we received cash and if the balances decreased, we can assume we paid on the debt unless we are given additional information on the subject. Notes Payable is the only liability we haven’t already accounted for on the balance sheet.

The cash purchase price and sales price of equipment are both shown in the investing section of the cash flow statement. On cash flow statements prepared using the indirect method, any loss or gain on the sale of equipment appears in the operating section as a reconciling item between net income and cash flow from operations. If a fixed asset’s balance increases from one year to the next, it means that more must have been purchased and there was a cash outflow.

The seller agreed to finance the purchase as long as Gondor Company can pay at least 20% of the selling price. Gondor Company agreed to pay the 20% down payment ($10,000); the rest will be financed. We will demonstrate the loss on the disposal of an asset in Good Deal’s next transaction. So… we add back the Loss of $20 in CFO, and then in CFI, we subtract out the $20 again, and also show the book value of $100 for the Assets we just sold, so that $80 shows up in CFI.

An increase in salaries payable therefore reflects the fact that salaries expenses on the income statement are greater than the cash outgo relating to that expense. This means that net cash flow from operating is greater than the reported net income, regarding this cost. Propensity Company had a decrease of $4,500 in accountsreceivable during the period, which normally results only whencustomers pay the balance, they owe the company at a faster ratethan they charge new account balances.