List all the current assets and liabilities and the difference between years. Then determine if the amount should be positive or negative using the rules. Preparing for the CFA Exam requires a thorough understanding of “Analyzing Statements of Cash Flows I,” a fundamental aspect of financial analysis. Mastery of cash flow classification, assessment of operating, investing, and financing activities, and understanding cash flow implications is essential. This knowledge provides insights into a company’s liquidity, operational efficiency, and financial health, which are crucial for a high CFA score. If you do your own bookkeeping in Excel, you can calculate cash flow statements each month based on the information on your income statements and balance sheets.

- The change in the liability account is the difference in the expense incurred that is included in net income and cash actually paid for the expense this period.

- Long Term Debt increased this year, therefore, the company borrowed money.

- Once cash flows generated from the three main types of business activities are accounted for, you can determine the ending balance of cash and cash equivalents at the close of the reporting period.

- Total cash from operating activities must be the same for both methods.

- Financing cash flows are calculated by adding up the changes in all the long-term liability and equity accounts.

What are the two ways to prepare Cash Flow statements?

That means we’ve paid $30,000 cash to get $30,000 worth of inventory. But here’s what you need to know to get a rough idea of what this cash flow statement is doing. So let’s start with a little practice problem here, and then I’m going to show you a cash flow statement on the next page. Total cash from operating activities must be the same for both methods. There are multiple ways to calculate FCFF but this is the simplest way using your cash flow statement. In any case, you should aim to move towards positive net cash flow over time if you want to stay in business.

The Difference Between a Balance Sheet and a Cash Flow Statement

Here’s a look at what a cash flow statement is and how to create one. Cash flow related to shareholders is reported in the financing section. This information is helpful so that management can make decisions on where to cut costs.

Calculate Ending Balance

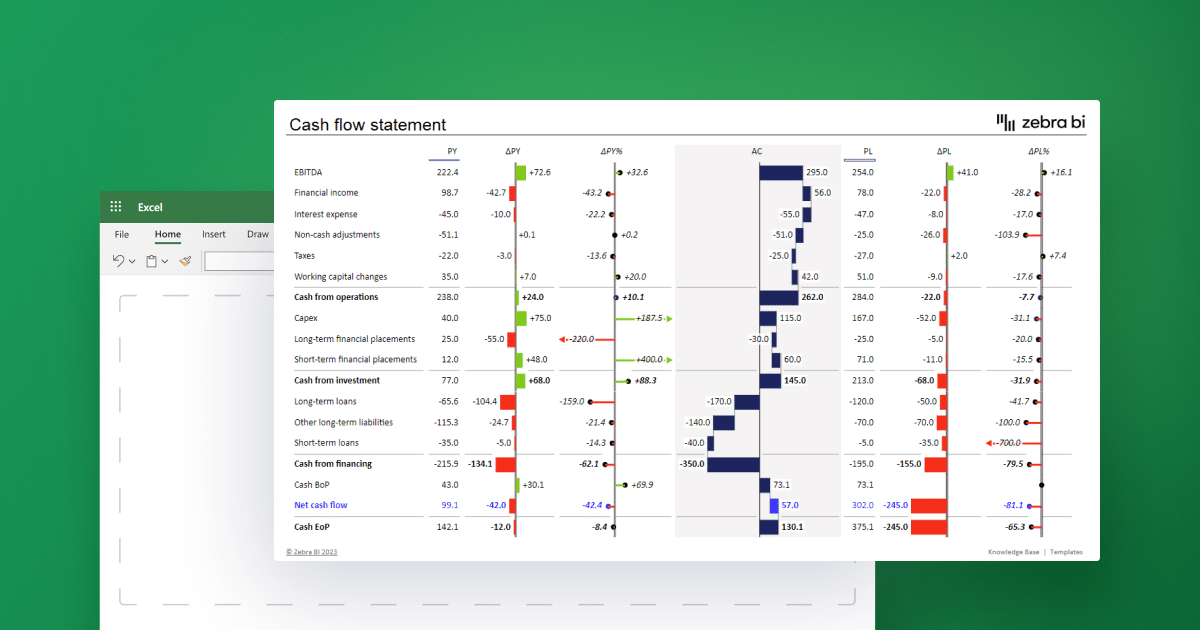

Additionally, it shows where we find the calculated or referenced data to fill in the forecast period section. When all three statements are built in Excel, we now have what we call a “Three-Statement Model”. As we have seen from our financial model example above, it shows all the historical data in a blue font, while the forecasted data appears in a black font. The table below serves as a general guideline as to where to find historical data to hardcode for the line items.

CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. LO 16.5The following shows excerpts from financialinformation relating to Stanwell Company and Thodes Company.

Well, that gives us predictive value of what it’s going to be doing in the future. It helps us evaluate management, right, because we can evaluate how management uses cash flows, the cash that it brings into the business and how it uses it in the business. When we have best invoicing software for small businesses 2021 to pay interest or pay dividends, well, we need cash to do those transactions, so the statement of cash flows is a good place to get information about that. And it, lastly, it gives us a little more information between the relationship of net income and cash flow.

If you’re wondering how to make a cash flow statement, these steps can guide you through the process, from gathering initial data to calculating the final cash balance. Gain or loss on the sale of equipment is reported in the operating section. Therefore, it should always be used in unison with the income statement and balance sheet to get a complete financial overview of the company.

When you have a positive number at the bottom of your statement, you’ve got positive cash flow for the month. Keep in mind, positive cash flow isn’t always a good thing in the long term. While it gives you more liquidity now, there are negative reasons you may have that money—for instance, by taking on a large loan to bail out your failing business. On top of that, if you plan on securing a loan or line of credit, you’ll need up-to-date cash flow statements to apply. Only the cash related to the long-term asset or long-term liability is reported in the investing and financing section. Do not just write the account name and the change in the account.