LO 16.2Describe three examples of financingactivities, and identify whether each of them represents cashcollected or cash spent. LO 16.2Describe three examples of investingactivities, and identify whether each of them represents cashcollected or cash spent. LO 16.2Describe three examples of operatingactivities, and identify whether each of them represents cashcollected or cash spent. The gain can also be computed as the difference in book value and cash received. The change in the long-term liabilities indicates repayment and borrowing of cash.

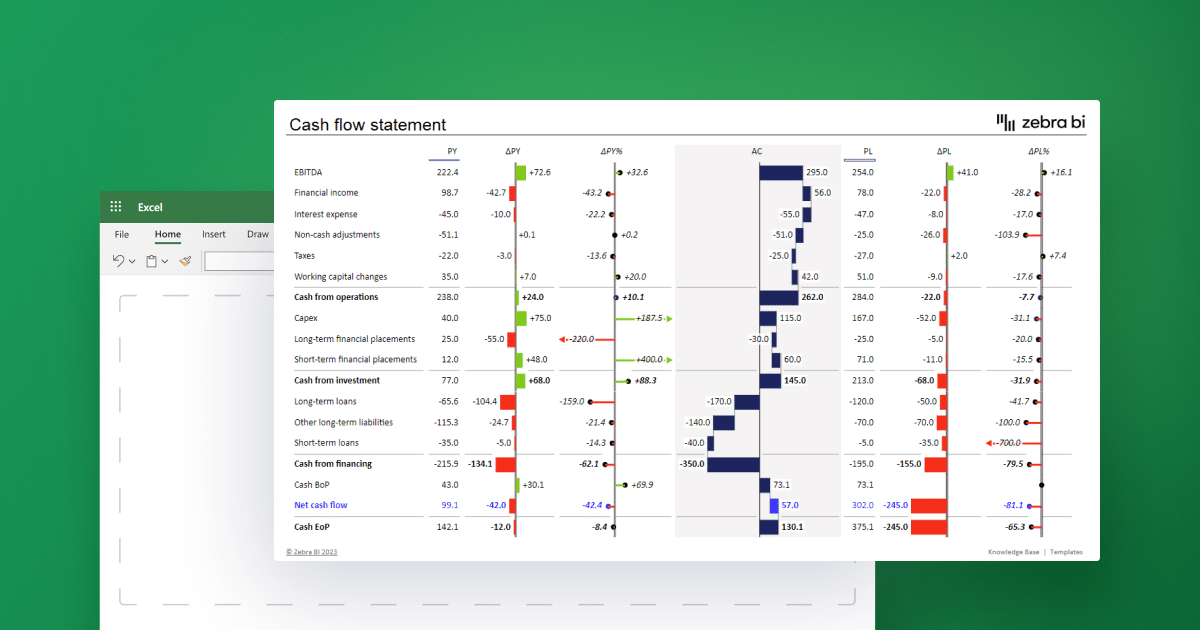

What is the Statement of Cash Flows?

- The Cash Flow statement tells you how your company got its cash balance at the beginning of the period compared to the end.

- If this number is negative, you have a serious problem because it indicates your company’s operations aren’t currently cash-positive.

- If splitting your payment into 2 transactions, a minimum payment of $350 is required for the first transaction.

- But here’s what you need to know to get a rough idea of what this cash flow statement is doing.

- For instance, if a company realizes that it will have a cash shortfall in the next month, it can take steps to ensure enough funds are available.

Some of the most common and consistent adjustments include depreciation and amortization. The cash flow statement helps business owners, investors, and financial managers see the “real” cash available to pay bills, invest in growth, or handle unexpected expenses. Together with the income statement and balance sheet, this statement adds depth to the financial overview, especially for understanding how cash flows in and out over time. Since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period.

What are the classifications of cash flows?

This is the first section, arguably the most important section because that’s our core business. So the investing section relates to the purchase and sale of long-term assets. So this is when we’re buying equipment or selling equipment for cash.

Cash Flow from Financing Activities

It reveals how cash is generated and used in operating, investing, and financing activities. By analyzing these sections, investors can assess whether management is efficiently using cash to support the company’s core operations, invest in long-term assets, and manage debt and equity. Consistent positive cash flows from operations, prudent investments, and effective financing strategies indicate strong management performance. So we’ve got operating activities, investing activities, and financing activities.

Why do you need cash flow statements?

For investing and financing sections you must give a description of what happened. The change in cash should agree with the change in cash on the balance sheet. Current year is $5,000 and prior year was $7,000, a decrease of $2,000. The idea is to understand the business’s ability to generate cash after spending on operations and capital assets—two vital things for keeping the business going. After you’ve added all the line items, sum up the figures to calculate the net cash flow from the operating section.

The cash flow statement is required for a complete set of financial statements. The cash flow statement is the name commonly used by practicing accountants for the statement of cash flows or SCF. We will use these names interchangeably throughout our explanation, practice quiz, and other materials.

Let’s take a closer look at what cash flow statements do for your business, and why they’re so important. Then, we’ll walk through an example cash flow statement, and show you how to create your own using a template. The issuance of debt is a cash inflow, because a company finds investors willing to act as lenders. However, when these debt investors are paid back, then the repayment is a cash outflow. The items in the operating cash flow section are not all actual cash flows but include non-cash items and other adjustments to reconcile profit with cash flow. Below is a breakdown of each section in a statement of cash flows.

Young companies and those in high-growth periods often have negative cash flows. Most of the cash flows in through financing activities and is spent on buying assets, hiring employees, and developing the product. A cash flow statement in a financial model in Excel displays both historical and projected data. Before this model can be created, we first need to have the income statement and balance sheet built in Excel, since that data will ultimately drive the cash flow statement calculations. The most common method of preparing the statement of cash flows.

To calculate the ending balance, sum up the net cash flow for all categories and add the opening cash balance. If this number is negative, you have a serious problem because c corporation taxes it indicates your company’s operations aren’t currently cash-positive. If this wasn’t intentional (or expected), your priority needs to be getting back in the black here.

Analyze the importance of cash flow trends in assessing liquidity and solvency. Additionally, assess how cash flow analysis informs investment strategies, credit decisions, and the overall evaluation of a company’s financial sustainability in a competitive market. The statement of cash flows helps evaluate management’s effectiveness by showing how well they manage the company’s cash.